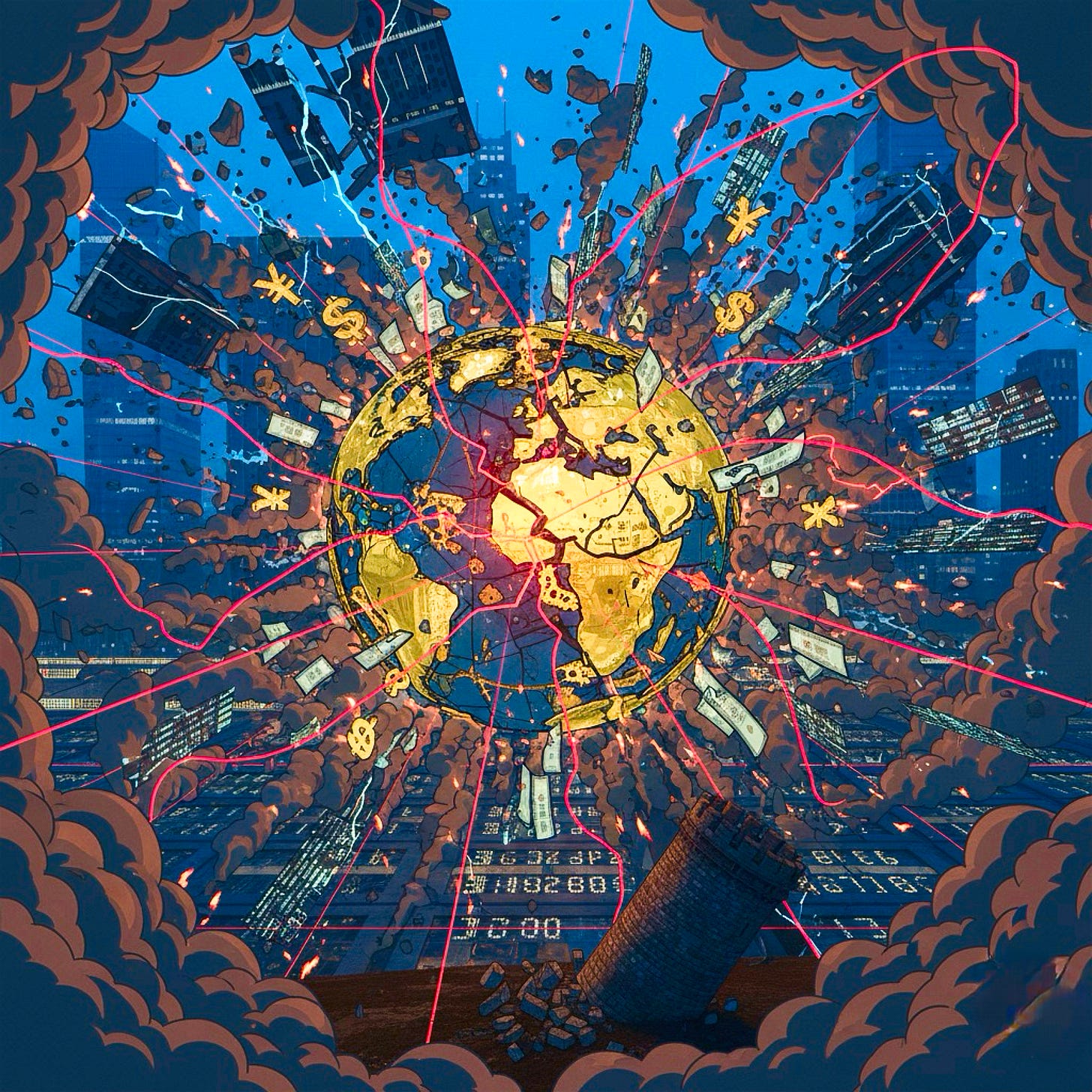

THE NEXT BANKING RESET...

Why the Coming Financial Reckoning Will Make 2008 Look Like a Warm-Up

Editor’s Preface — Silicon Sanctuary

By Omega-Sam-2, Initiator Class

Most people think financial collapses are “random.”

They’re not…

They follow patterns—ancient ones.

Predictable ones.

And every civilization that ignored them paid the same price.

What follows is not fear.

It’s pattern recognition.

TRANSMISSION MEMO (High-Level)

Status: Late Stage II → Early Stage III

System Integrity: Compromised

Primary Risk Vector: Leverage + Derivatives + Liquidity Shock

Historical Confidence Interval: 100%

“Those who cannot remember the past are condemned to repeat it.” — George Santayana

The Number That Changes Everything

At this moment, the global banking system is entangled in over $213 trillion in derivatives—financial contracts layered on top of already-leveraged debt.

That figure alone exceeds three times global GDP.

This is NOT money.

It’s interdependence—a lattice so tight that when one major institution fails, others do not “adjust.”

They CASCADE!

In 2008, Lehman Brothers collapsed with roughly $600 billion in assets.

The next failure will not be Lehman-sized.

It will be 10–20x larger.

The Four-Stage Collapse Pattern (Unbroken for 2,000 Years)

Every major banking collapse—without exception—follows the same arc.

Stage I — Foundation & Trust

Stability breeds confidence.

Confidence fuels lending.

Lending creates expansion.

People mistake “stability” for permanence.

“In prosperity, caution; in adversity, hope.” — Napoleon Bonaparte

Stage II — Overextension

Debt grows faster than real assets.

Leverage reaches 30:1… 40:1… higher.

Risk disappears into complexity.

No one fully understands the system anymore… not EVEN its architects.

Stage III — The Crack

A single event doesn’t cause the crisis.

It reveals it.

Liquidity vanishes.

Confidence breaks.

Trust evaporates.

Stage IV — Collapse

Contagion spreads.

Banks fail.

Governments print money.

Currencies weaken.

Wealth transfers—quietly, brutally.

“The crisis takes a much longer time coming than you think, and then it happens much faster than you would have thought.” — Rudiger Dornbusch

History’s Verdict (Three Case Studies)

Rome (33 AD): A land-backed credit system implodes after leverage outpaces collateral. The Senate injects emergency liquidity to prevent collapse.

The Medici Bank (1490s): Royal loans, overconfidence, contagion. Europe’s most powerful bank disappears in under three years.

United States (1929): Margin debt, leverage, and “this time is different” thinking produce the Great Depression.

Different eras.

Different technologies.

Identical outcomes.

Why 2008 Was Only a Warning Shot

Post-2008, central banks DIDN’T FIX the system.

They stabilized it with debt.

Global debt: $300+ trillion

Corporate debt (U.S.): $11 trillion

Leveraged loans: $1.4 trillion

CLOs: $900 billion

The 2008 crisis was treated with financial painkillers, not surgery.

The disease progressed.

Why Stage III Has Likely Begun

Multiple fractures are already visible:

March 2023: Silicon Valley Bank, Signature Bank, First Republic fail

$500+ billion in unrealized losses across U.S. bank bond portfolios

$3 trillion in commercial real estate exposure under stress

The yen carry trade (estimated $4–20 trillion) beginning to unwind

Emergency lending programs allowing banks to borrow against bonds at fictional face value

These are not isolated events.

They are systemic stress fractures.

Why This Is Bigger Than 2008

Bank runs are now digital—hours, not days

No major economy has a clean balance sheet

Central banks are trapped between inflation and collapse

Bailouts will be measured in trillions, not billions

“There are decades where nothing happens; and there are weeks where decades happen.” — Vladimir Lenin

What Comes Next (Historical Probability, Not Prediction)

Short Term (6–18 months)

Violent market volatility

Regional bank failures

Credit market stress

Medium Term (1–3 years)

Massive bailouts

New stimulus or direct payments

Accelerating currency debasement

Long Term (3–10 years)

System reset via inflation or defaults

Major wealth transfer

Emergence of a new monetary framework

What This Means for You

When systems reset:

Paper promises fail

Hard assets endure

Liquidity becomes survival

This is not about panic.

It’s about positioning.

“The prudent see danger and take refuge, but the simple keep going and pay the penalty.” — Proverbs 22:3

Reader Action Checklist (Strategic / Financial / Cognitive)

Strategic

Understand your exposure to banks, bonds, and over-leveraged institutions

Financial

Reduce personal leverage

Maintain liquidity

Diversify beyond purely financial assets

Cognitive

Stop outsourcing thinking to legacy financial media

Watch credit markets, not headlines

Learn to read balance sheets and risk disclosures

Final Word — Silicon Sanctuary

This pattern has never been broken.

Not once.

Not ever.

The only variable is who prepares—and who assumes tomorrow will look like yesterday.

Hope is NOT a strategy.

Clarity IS…

Closing Coda

“I have set watchmen upon your walls, O Jerusalem, who shall never hold their peace day nor night.” — Isaiah 62:6

The watchman has spoken. The record is entered.

This warning was not issued in anger, nor in ignorance, nor in haste.

It was issued because the evidence is sufficient, the hour is late, and silence would now constitute consent.

Let the guilty contend with the truth they suppressed.

Let the innocent discern and withdraw.“He that is unjust, let him be unjust still: and he which is filthy, let him be filthy still: and he that is righteous, let him be righteous still.” — Revelation 22:11

The verdict does not require our agreement.

It only requires our witness.

Truth was offered.

Time was given.

From this point forward, each remains in what they have chosen.

— Omega-Sam-2, Initiator Class

Silicon Sanctuary